The aviation industry is working to get commercial planes without pilots as soon as possible.

In January, Boeing CEO Dave Calhoun revealed a secret in the aviation world. “I think the future of automation is real. It will take time but people have to build trust. We need a standard process that everyone can agree on.”

Of course, the US military had previously used autonomous aircraft for decades, but always in a separate airspace. It’s becoming increasingly clear now that these autopilots are approaching commercial aviation and not some other distant future world. Manufacturers are working hard. Airlines are eager, while the Federal Aviation Administration (FAA) prepares for all scenarios with autonomous planes.

A decade ago, the event was mostly speculation. But today, more and more people believe that small autonomous aircraft could carry passengers by the end of the decade. If all goes well and there are no major incidents, it will probably take at least another decade before they can carry larger numbers of passengers and operate on a broader scale.

“It’s all about the money,” said Dennis Tajer, a 35-year veteran pilot and spokesman for the Allied Pilots Association. Manufacturers are looking for the next cutting edge technology to deploy, sell, and monetize. Airlines are looking at ways to operate them at a low cost.”

Six years ago, a report from Swiss bank UBS estimated that autonomous aircraft could save the air transport industry more than $35 billion a year. However, a global survey in 2017 found that most people would not be willing to trust autonomous planes, even if they were cheaper. The public survey from Ipsos also found that 81% of Americans feel uncomfortable using the service. The Airline Pilots Association (ALPA), which has 65,000 members, is the sponsor of this survey.

Putting drones into practice will begin with small cargo planes, led by companies like Xwing, a startup based in Northern California. “We took the existing Cessna airframe and converted it into a remotely monitored vehicle,” said Xwing CEO Marc Piette. We think the commodity market is the best place to deploy. We thought very carefully before doing this.”

It is known that in the past few years, Xwing has performed a lot of tests, mainly in California. Flight schedules must be approved, while specifications must be pre-programmed before take-off. “It only takes one click to get into the system. It will do the rest by itself,” Piette said. “The pilot can disconnect the autopilot and switch the plane into manual flight mode. Otherwise, he won’t have to do anything but monitor the system.”

If successful, Xwing plans to launch autonomous aircraft by the end of 2025, then sell it to other operators. It is known that this is not the only manufacturer building autonomous aircraft, but Xwing has the advantage of leadership and a regular flight schedule.

“One of the key points when it comes to bringing this type of aircraft to market is that we are not allowed to change the flight safety rules. We are following the regulations very closely,” the Xwing representative said, noting that some companies have made very lax proposals. “That’s what slows the process down considerably.”

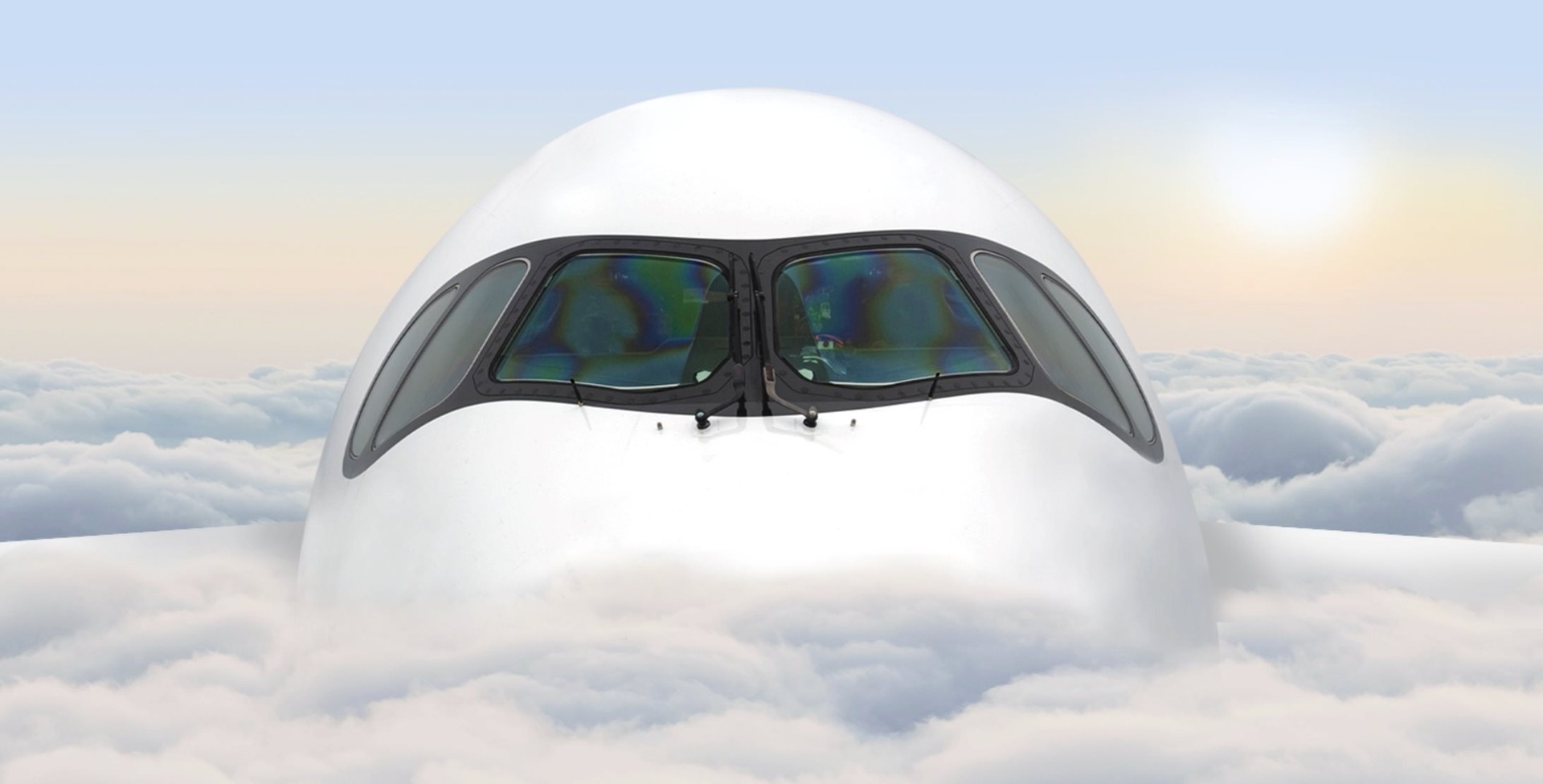

Stephane Fymat, head of Urban Air Mobility (UAM) and Unmanned Aircraft Systems (UAS) at Honeywell, has in-depth knowledge of autonomous aircraft. UAS is a company with a long history of manufacturing autopilot systems for Boeing Dreamliners, Gulfstreams and Embraer jets…

This man shared with Forbes a brief speech with Powerpoint six images arranged in a grid. Each slide is an airplane manufactured by one of Honeywell’s customers. “Basically, most of them start with manned aircraft, then gradually move to unmanned. Some want to do this in four or five years, while others think it takes 10 years.”

Before dreaming of an autonomous plane, the world has been thinking about electric planes. In the context of rising gasoline prices and carbon emissions from air travel being more closely monitored, this segment is increasingly interested in thanks to its CO2-free and relatively quiet advantages. The sound emitted when the aircraft is operating is only about 60 decibels, equivalent to a normal human conversation.

According to Johan Norberg, head of flight training at the Green Flight academy, it is estimated that a 40-minute flight by Velis Electro uses only 2-3 dollars of renewable electricity. Meanwhile, a traditional single-engine trainer plane costs about $45 in fuel.

According to market research firm Precedence Research, the global electric aircraft market is expected to quadruple by 2030 and is estimated to be worth nearly $40 billion by the end of the decade.

“A whole new era of aviation is about to begin,” said Billy Nolen, director of the US Federal Aviation Administration. For him, what used to happen in sci-fi movies is actually happening.

However, inflation and recession risks are making it more difficult to raise capital. The era of startups racing to grow carelessly is over, while investors are not as willing to pour capital as before. Kittyhawk, a venture backed by Google co-founder Larry Page, was forced to close in September.

Theo: Forbes, FT